Return to Shareholders / Dividends

As of Jun 17.2025

Shareholder Return Policy

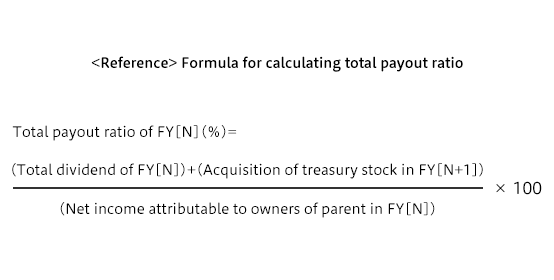

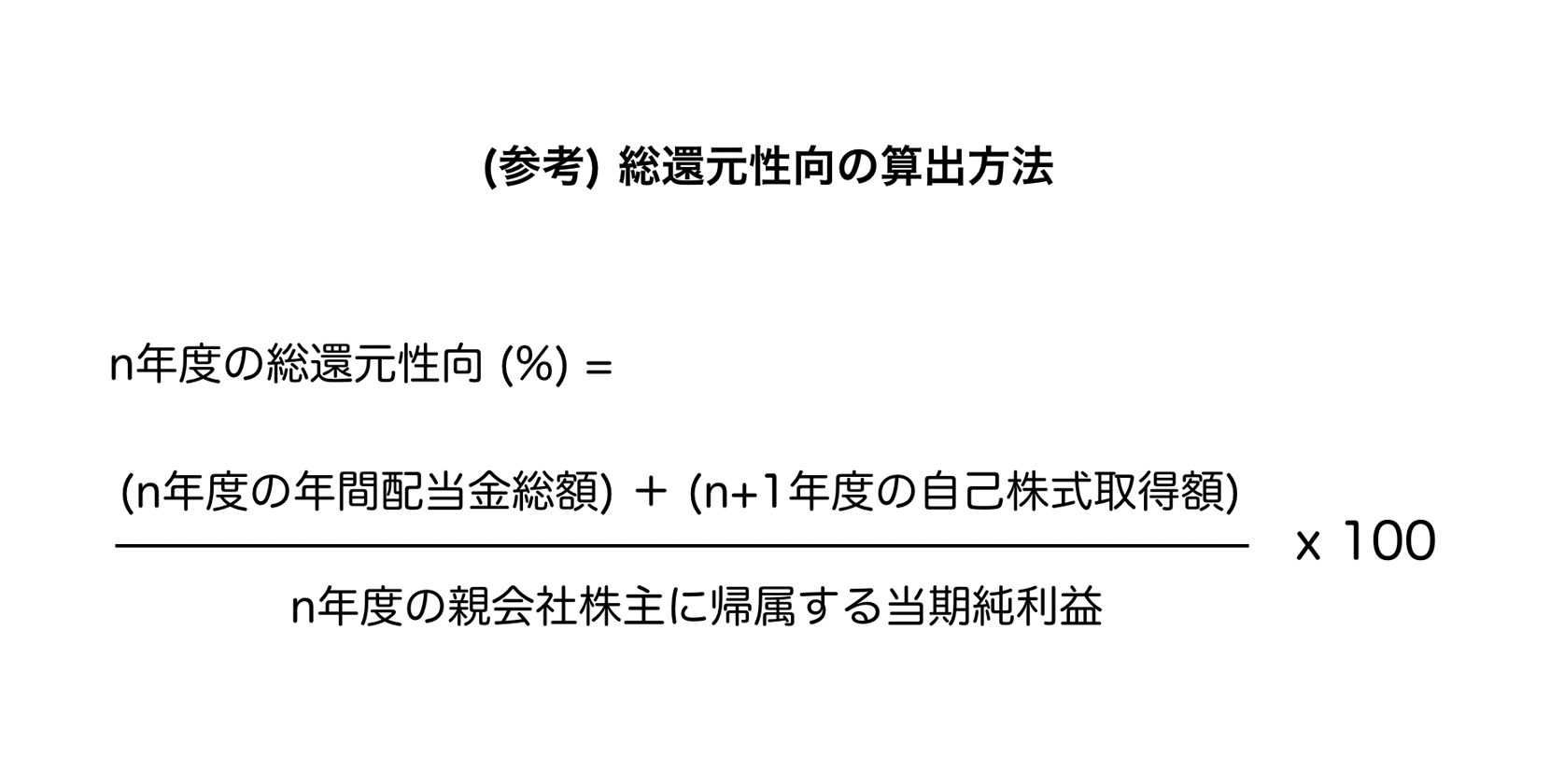

We endeavor to declare stable dividends and acquisition of treasury stock by setting a total payout ratio of 30% as we further strengthen the management foundation through the fiscal year 2024 (ending March 2025).

Furthermore, from fiscal year 2025 (ending March 2026) onward, we will endeavor to invest in growth aimed at medium and long-term growth and keep improving capital efficiency in mind in providing shareholder returns, while maintaining financial soundness.

We will endeavor to declare stable annual dividends of at least ¥100 per share and flexibly acquisition of treasury stock based on cash flow while targeting a total payout ratio of around 50%.

Besides, we cap our treasury holdings at 5% of total issued shares and dispose of any holdings that exceed this cap.

Specific Figures for Dividend of Surplus

For FY2025, annual dividend will be increased from ¥55 per share to \60 (¥30 interim + ¥30 year-end). Shares will be repurchased with a cap of ¥5.8 billion.

For FY2026, annual dividend will be increased from ¥60 per share to \100 (¥50 interim + ¥50 year-end).

With regard to the acquisition of treasury stock, the Company plans to buyback stock based on the formula described above.

Changes in Shareholder Returns

| FY2022 (2022/3) |

FY2023 (2023/3) |

FY2024 (2024/3) |

FY2025 (2025/3) |

FY2026 (2026/3) |

||

| Dividends | Annual dividend per share (yen) |

50.00 | 50.00 | 55.00 | 60.00 | 100.00 (forecast) |

| Interim dividend (yen) | 25.00 | 25.00 | 25.00 | 30.00 | 50.00 (forecast) |

|

| Annual dividend | 12.1 billion yen | 12.1 billion yen | 13.3 billion yen | 14.4 billion yen | ||

| Acquisition of Treasury Stock | Number of stocks acquired (stocks) | - | 437,900 | 1,676,200 | 1,700,000 (maximum) |

|

| Acquisition amount | - | 2.0 billion yen |

7.1 billion yen |

5.8 billion yen (maximum) |

Notes:

1.Shares acquired by requesting purchase of shares less than one unit are not included.

2.The annual dividend and the acquisition amount of treasury stock have been rounded to the nearest 100 million yen.